Understanding Business Loss Insurance

What business owners should consider when they are told their losses are not covered

by Rob Ammons, The Ammons Law Firm

Being a business owner right now is difficult. Between Coronavirus damage and orders from state and local governments, most businesses have shut down. While businesses are closed, fixed expenses (e.g. rent, utilities, insurance) drain cash reserves. As commerce in many sectors of our nation’s economy has ground to a halt, most businesses have been forced to close, and for some, the only option has been to furlough employees.

Being a business owner right now is difficult. Between Coronavirus damage and orders from state and local governments, most businesses have shut down. While businesses are closed, fixed expenses (e.g. rent, utilities, insurance) drain cash reserves. As commerce in many sectors of our nation’s economy has ground to a halt, most businesses have been forced to close, and for some, the only option has been to furlough employees.

Many business owners were diligent, purchased insurance, and paid premiums for years in order to have coverage for business losses. Often insurance agents and brokers promoted the insurance by describing the policy as a “safety net” in case there was a business interruption. But now when the coverage is needed the most, insurance companies and agents are telling businesses that their losses are not covered. One thing is certain: when it comes to protecting policyholders against business losses associated with the Coronavirus Pandemic, business owners are finding out that the insurance industry is not a good neighbor and not on their side.

Despite what businesses are being told, there may be insurance coverage for losses associated with the Coronavirus Pandemic. Whether a business is covered for the current interruption in its activities is a question that requires an analysis of the specific language of the insurance policy including all exclusions, a review of the government order closing local businesses, and knowledge of the legal precedent interpreting insurance policies. When it comes to insurance coverage, the specific language of the policy makes a difference. While some policies have formidable exclusions that arguably eliminate coverage, there are many variations in the policy language and some policies may not exclude coverage.

In connection with most business loss claims associated with the Coronavirus Pandemic, three things that to look for in a commercial property insurance policy are (1) business interruption coverage, (2) civil authority coverage, and (3) microorganism coverage or exclusion.

Business Interruption Coverage

Business interruption coverage ensures a business for losses caused when its normal business operations are disrupted. This coverage is usually bundled with other types of coverage under a business owner’s policy, but some businesses may have separate policies that cover business-interruption losses.

A feature of business interruption coverage you will want to be aware of is the standard policy language in most policies that limits coverage to losses caused by “direct physical loss of or damage to property.” Based on the claim denial letters business owners are receiving, it appears that the insurance industry is taking the position that a virus in a business that attaches to surfaces, lives for days, is highly contagious and potentially deadly does not constitute any damage to the business owner’s property.

While no Court has yet ruled on whether the Coronavirus causes property loss or damage in a COVID -19 case, there are comparable situations where Courts have found the requisite property damage to invoke business interruption coverage. The language of the Harris County Judge’s Order that closed businesses should also be helpful to businesses when they challenge the denial of their insurance claims. Specifically, Harris County Judge Hidalgo’s Order states:

Whereas the COVID-19 virus is contagious and spreads through person-to-person contact, especially in group settings; and

Whereas the COVID-19 virus causes property loss or damage due to its ability to attach to surfaces for prolonged periods of time; and

Source: https://www.readyharris.org/Stay-Home

Based on this declaration, it can be argued that all businesses that are normally open to the public have suffered the type of property loss or damage necessary to trigger coverage under standard business interruption policy language.

Civil Authority Coverage

Many businesses have insurance policies that include “civil authority” coverage—a type of coverage for lost business income that should be available when your business is closed by order of a government entity. Seems clear. However, when it comes to insurance coverage issues, very little is black and white.

Insurance companies and their armies of lawyers are very creative when it comes to finding ways to deny coverage to businesses and policyholders. For example, after September 11, 2001, airspace was closed by the government. Airlines, hotels, restaurants, and other hospitality businesses were devastated by the loss of business they suffered due to the lack of airline travelers. Even though these businesses had civil authority coverage, insurers denied their claims, arguing that the government orders did not order that those businesses close. The same thing happened to businesses in Louisiana after hurricane Katrina. In those cases, the Courts sided with the insurance company claiming that the businesses were never actually ordered to close. [1]

But Coronavirus is different. The position that the insurance companies took in the wake of these past disasters can be used against them now! The same court decisions that favored insurance carriers in these past disasters can be used to make a strong case that civil authority coverage directly applies for business losses caused by government-ordered business closures due to the coronavirus.

Microorganisms

Since the outbreak of SARS in 2003, some insurance policies explicitly exclude damages caused by microorganisms. A standard insurance clause excludes payment “for loss or damage caused by or resulting from any virus, bacterium or other microorganism that induces or is capable of inducing physical distress, illness or disease.” Other policies, however, only exclude from coverage losses caused by bacteria, but not viruses like Coronavirus. Here again, a careful reading of the policy is crucial.

Insurers will likely also argue that standard policy language that bars coverage for damages caused by “pollution” or other exclusionary language applies to business losses caused by Coronavirus, and different courts have interpreted these provisions differently. So it is important that the specific policy language be reviewed by a lawyer familiar with the court decisions interpreting these provisions of the business insurance policy.

Finally, at least some policies that target the restaurant, gym, movie, healthcare, and similar industries industry explicitly provide coverage for losses caused by “communicable or infectious diseases,” without the need to show that the loss was the result of actual physical damage to property.

Conclusion

When business pay premiums for business interruption coverage, they expect to be covered if they are unable to continue normal operations. Business losses caused by Coronavirus are staggering. Business owners can expect the insurance industry to use every imaginable excuse to avoid covering these losses.

A prudent business owner should not rely on an insurance company or anyone beholden to the insurance industry to interpret the policy language or to tell them whether their business loss claim is covered. At the same time, it makes little sense for struggling business owners to incur more expense paying lawyers hourly fees to review their insurance policy language.

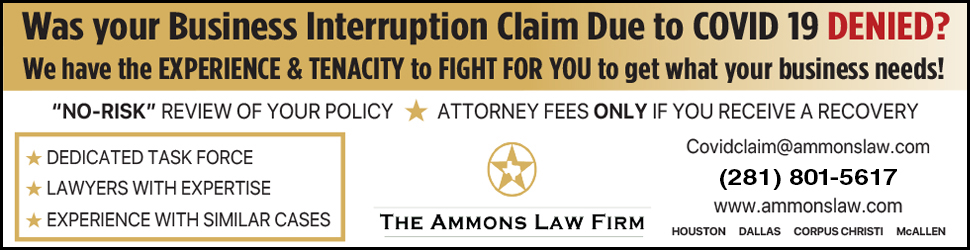

The Ammons Law Firm is currently reviewing business insurance policies under a contingency fee arrangement that requires payment only if a recovery is ultimately obtained for the business owner. This means that a business which has already lost revenue due to the shut down does not have to incur any out-of- pocket expense. Given the hefty premiums that business owners have paid for business loss insurance and the uniform way in which insurance companies are denying the claims, it cannot hurt to have a qualified lawyer review the policy language to determine whether payment may be owed for Coronavirus-related losses.

Rob Ammons is a business owner and the Founder of The Ammons Law Firm. He has been representing business owners and consumers in claims against insurance companies for over thirty years.

[1]See Kean, Miller, Hawthorne, D’Armond McCowan & Jarman, LLP v. Nat’l Fire Ins. Co. of Hartford, 2007 WL 2489711, at *4 (M.D. La. Aug. 29, 2007). But see Company Assurance Co. of Am. v. BBB Serv. Co., 593 S.E.2d 7, 7 (Ga. App. 2003); Narricot Indus., Inc. v. Fireman’s Fund Ins. Co., 2002 WL 31247972, at *4 (E.D. Pa. Sept. 30, 2002).