HOUSTON REAL ESTATE ON A RECORD PACE

Low interest rates inspired Houston consumers to snap up high-end homes in April at a pace never before seen, sending prices to new highs while keeping home inventory at historic lows. It must be noted that, as in March, some figures contained in this latest housing report are distorted because they compare to the same month last year when real estate was just beginning its recovery from coronavirus-related lockdown orders that halted most of the business.

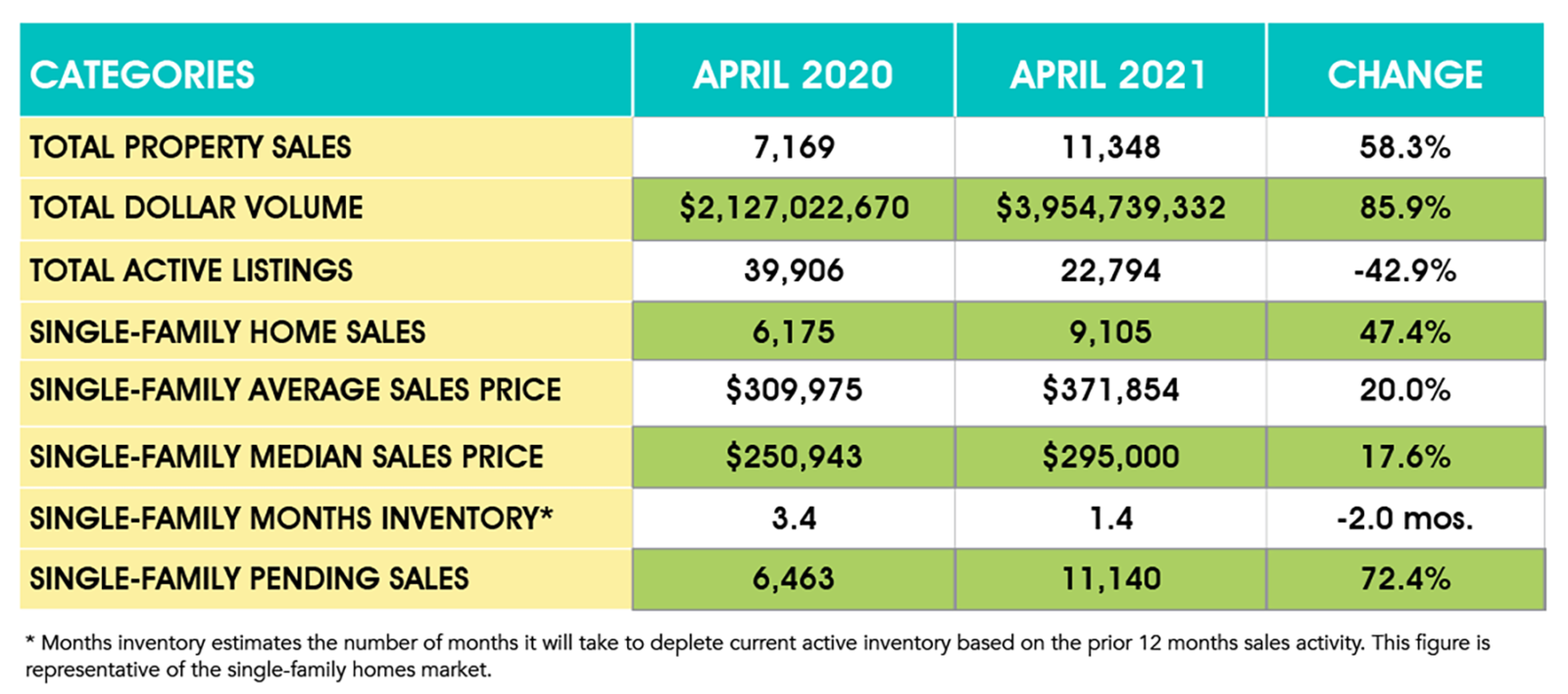

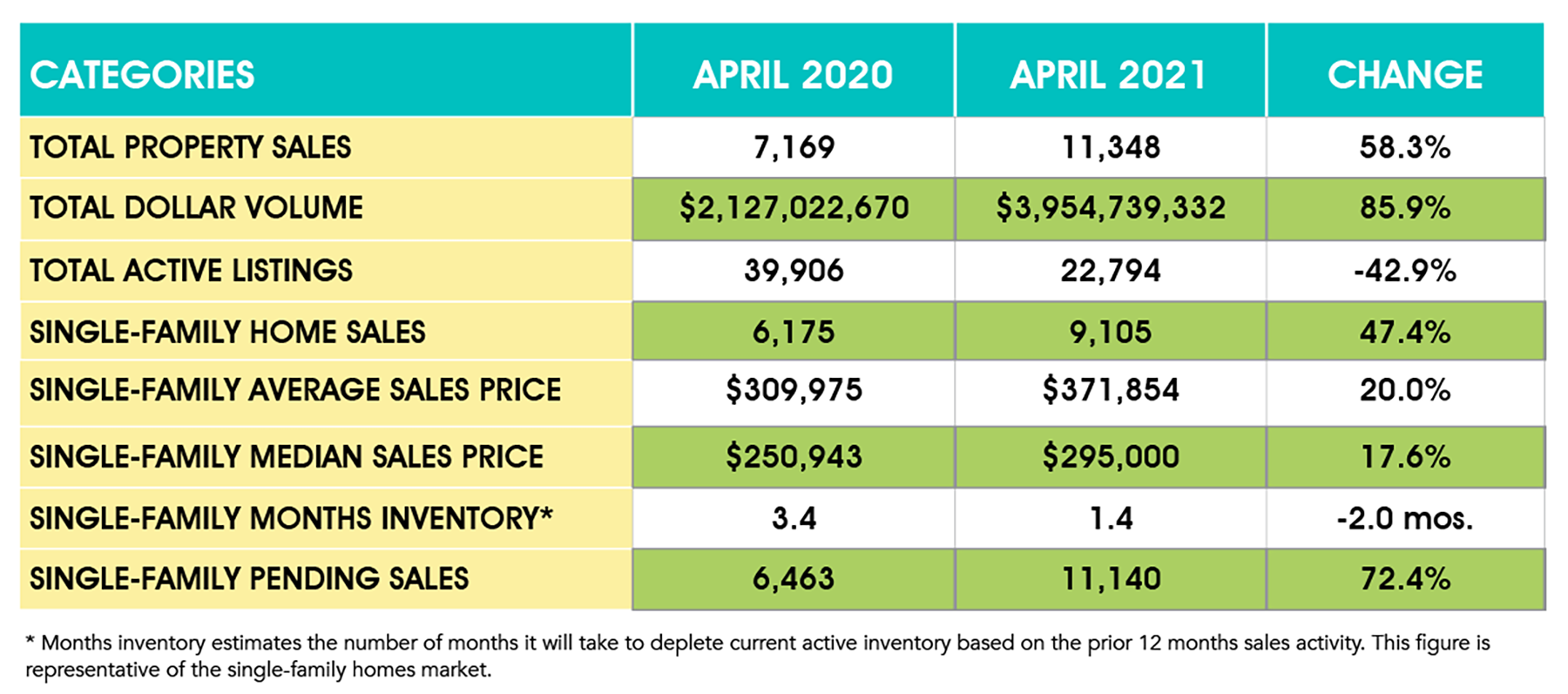

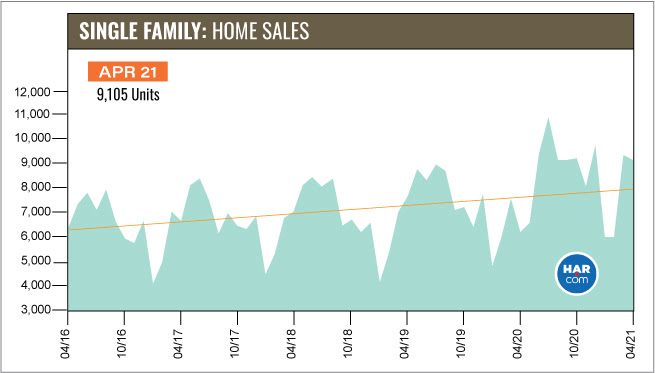

According to the latest Houston Association of Realtors (HAR) Market Update, single-family home sales were up 47.4 percent compared to last April with 9,105 units sold versus 6,175 a year earlier. That represents the biggest one-month year-over-year sales volume increase of all time and is the market’s eleventh consecutive positive month of sales. On a year-to-date basis, home sales are 24.4 percent ahead of 2020’s record pace.

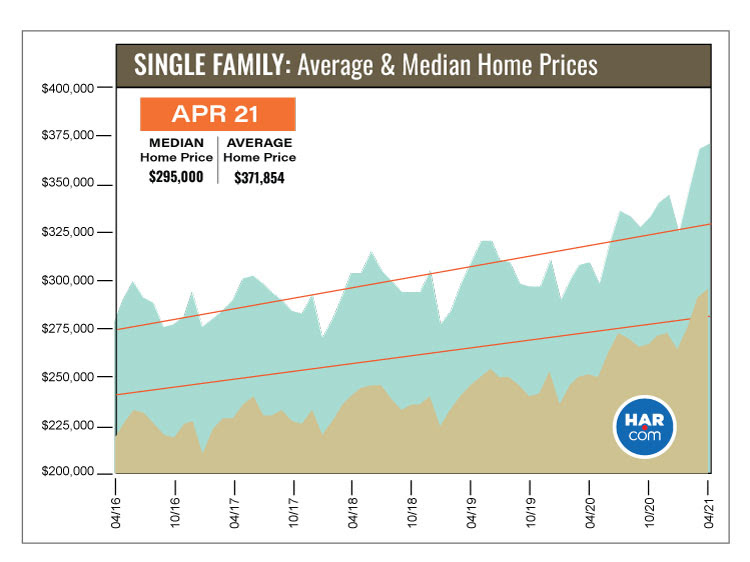

Homes priced from $750,000 and above led the charge in sales volume in April with a staggering 164.3 percent year-over-year surge. That was followed by the $500,000 to $750,000 segment, which soared 132.2 percent. With high-end homebuying overshadowing the marketplace, pricing climbed to new record levels. The single-family home average price rose 20.0 percent to $371,854 and the median price increased 17.6 percent to $295,000.

Sales of all property types totaled 11,348. That is up 58.3 percent from April 2020. Total dollar volume for the month rocketed 85.9 percent to just under $4 billion.

“In my 20 years in real estate, I have never seen such dramatic forces sweeping across the Houston housing market as we have experienced since the coronavirus pandemic began,” said HAR Chairman Richard Miranda with Keller Williams Platinum. “The market is humming along at a record pace, fueled by low mortgage rates despite dwindling inventory and rising prices. However, without a healthy boost in new listings in the weeks and months ahead, the current pace of sales cannot be sustained.”

Lease Property Update

Lease properties staged a mixed performance in April. Single-family lease homes fell 3.4 percent year-over-year while leases of townhomes and condominiums increased 15.1 percent. The average rent for single-family homes jumped 11.0 percent to $1,960 while the average rent for townhomes and condominiums rose 8.0 percent to $1,688.

April Monthly Market Comparison

With frenzied buying taking place at the high end of the market and inventory holding at its lowest level of all time, the Houston housing market achieved the eleventh straight month of positive sales in April. HAR again notes that some of the data in this report are distorted because the sales activity is being compared to April of 2020 when the real estate business was just ramping back up following COVID-related lockdowns.

April sales trends were largely positive. Single-family home sales, total property sales and total dollar volume all rose compared to April 2020. Pending sales shot up 72.4 percent. However, total active listings – or the total number of available properties – fell 42.9 percent with new listings dramatically outpaced by sales.

Despite a 26.8 percent year-over-year increase in new listings in April, strong buyer demand and surging sales dropped single-family homes inventory to a 1.4-months supply versus 3.4 months a year earlier. That is unchanged from last month’s level, which remains the lowest inventory of all time. Housing inventory nationally stands at a 2.1-months supply, according to the National Association of Realtors (NAR).

Single-Family Homes Update

Single-family home sales surged 47.4 percent in April with 9,105 units sold across the greater Houston area compared to 6,175 a year earlier. Heavy sales volume among homes at the high end of the market boosted pricing to record highs. The single-family home average price climbed 20.0 percent to $371,854 while the median price rose 17.6 percent to $295,000.

The time it took to sell a home fell by more than two weeks versus April 2020. Days on Market (DOM) went from 58 to 40. Due to strong buyer demand and surging home sales, inventory registered a record low 1.4-months supply compared to 3.4 months a year earlier. That figure is unchanged from March 2021 and is below the current national inventory level of 2.1 months recently reported by NAR.

- $1 – $99,999: decreased 27.6 percent

- $100,000 – $149,999: decreased 23.7 percent

- $150,000 – $249,999: increased 5.1 percent

- $250,000 – $499,999: increased 80.6 percent

- $500,000 – $749,999: increased 132.2 percent

- $750,000 and above: increased 164.3 percent

HAR also breaks out sales figures for existing single-family homes. Existing home sales totaled 7,340 in April, up 54.0 percent compared to the same month last year. The average sales price jumped 24.5 percent to $372,884 while the median sales price climbed 23.6 percent to $293,000.

For HAR’s Monthly Activity Snapshot (MAS) of the April 2021 trends, please click HERE to access a downloadable PDF file.

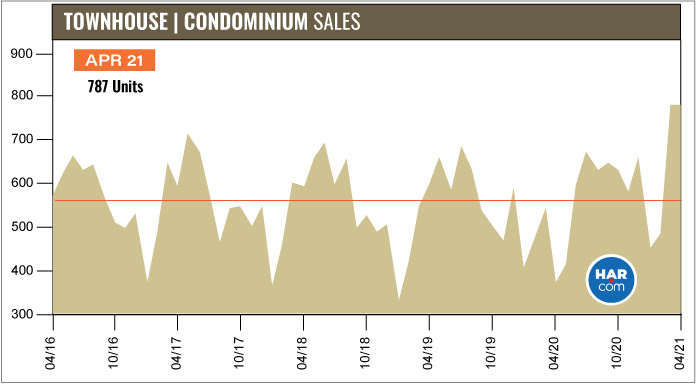

Townhouse/Condominium Update

Sales of townhouses and condominiums increased for the eighth consecutive month in April, rocketing 112.7 percent with 787 closed sales versus 370 a year earlier. Pricing reached record highs with the average price increasing 8.8 percent to $246,940 and the median price climbing 11.0 percent to $200,000. Inventory fell from a 4.4-months supply to 2.8 months.

- Single-family home sales increased for the eleventh consecutive month, up a dramatic 47.4 percent year-over-year with 9,105 units sold;

- The Days on Market (DOM) figure for single-family homes dropped from 58 to 40;

- Total property sales rose 58.3 percent with 11,348 units sold;

- Total dollar volume increased 85.9 percent to about $4.0 billion;

- The single-family average price reached a record high, rising 20.0 percent to $371,854;

- The single-family median price climbed 17.6 percent to $295,000 – also a record high;

- Single-family homes months of inventory registered a historic low 1.4-months supply, down from 3.4 months year-over-year and below the national inventory of 2.1 months;

- On a year-to-date basis, single-family home sales are running 24.4 percent ahead of 2020’s record pace.

- Townhome/condominium sales shot up 112.7 percent and reached record-level pricing with the average price up 8.8 percent to $246,940 and the median price up 11.0 percent to $200,000;

- Single-family home rentals fell 3.4 percent with the average rent up 11.0 percent to $1,960;

- Townhome/condominium leases rose 15.1 percent with the average rent up 8.0 percent to $1,688.